It's a GRS tradition! Each year on Halloween, I publish a story about planning for death. Usually these are general articles about estate planning. This year's story is personal.

When my best friend died in 2009, one of my biggest regrets was that I hadn't made time to travel with him.

Sparky had previously asked me to join him on trips to Burning Man (in 1996) and southeast Asia (in 1998) and Mexico (in 2003). I'd declined each invitation, in part because I was deep in debt but also because I thought there'd be plenty of time to do that sort of thing in the future.

Turns out, there wasn't plenty of time to do that sort of thing in the future.

After Sparky died, I resolved to make the most of opportunities like this. Being in a better financial position helped. Having ample savings gives me the flexibility to join friends on short adventures or to explore the U.S. by RV for fifteen months without money worries. (Yes, I realize that's a fortunate position to be in.)

Here's an example. In 2012, my cousin Duane asked me to join him for a three-week trip to Turkey. Remembering my vow after Sparky's death (and remembering the power of yes), I agreed. That trip to Turkey is one of the highlights of my life so far. I'm glad I did it. It was worth every penny.

The Best Laid Plans

Early in 2017, Duane contacted me. “This fall will be the five-year anniversary of our trip to Turkey,” he said. “Want to have another big adventure?”

“Sure!” I said. So, we started planning.

We bought books, watched videos, and browsed websites. We invited Kim to join us. Over the course of several months, our plans crystalized. We'd fly to Paris, rent a car, then spend three or four weeks driving around France and Spain and Portugal, enjoying festivals, experiencing the grape harvest, and exploring ruins. (Duane loves ruins!)

In June of last year, I sent Duane an email. “I'm going to buy plane tickets tomorrow. Do you want me to buy yours?”

“Hold up,” he responded. “We need to talk.” He called me on the phone.

“What's going on?” I asked.

“Well, J.D., it's like this,” he said. “I have cancer. I've been having problems with my throat for a few months, but I thought that was because of indigestion or something. It's not indigestion. I have throat cancer.”

Long-time GRS readers know about the curse afflicting the men of my family. We die young because of cancer. My father died of cancer ten days before his fiftieth birthday. Duane's father died of cancer at age 51. Duane's brother died of cancer at 47. Now Duane was telling me that he had cancer at age 53. (Is there any wonder I fear I'll die of cancer in the next few years?)

“Holy shit,” I said. “Are you serious?”

“Yes,” Duane said. “And the prognosis isn't good. I need to start chemo as soon as possible, which means I won't be able to do this trip. You and Kim should go without me.”

We did not go without him. We discussed doing so, but felt like it wouldn't be the same. (Instead, Kim and I took the money we would have used to see France, Spain, and Portugal, and used it to remodel our new house.)

Fortunately, Duane's treatment seemed to work. His cancer went into remission. Although things were scary there for a while, his health began to improve.

Things Come Undone

Two months ago, at the end of August, Duane invited me to join him for a mid-week trip to the Oregon coast.

“Can I bring the dog with me?” I asked.

“Sure,” he said.

On a sunny Wednesday, we piled into my Mini Cooper and drove the ninety minutes to Seaside, Oregon. There, we walked on the beach, bought saltwater taffy, and ate clam chowder for lunch. We talked about a variety of nerdy things.

You see, Duane is a nerd just like me.

- Like me, he loves his videogames. (In fact, he likes videogames more than I do.)

- He's an avid player of Magic: The Gathering.

- He used to collect semi-official Canadian airmail stamps.

- For 20+ years, he's collected ancient coins. (By which I mean coins from before the birth of Christ.) His desk at the box factory used to be covered with uncleaned coins that he was soaking to remove centuries of dirt and grime.

Duane is also a money nerd. In fact, were it not for Duane, it's unlikely that I would be a money nerd.

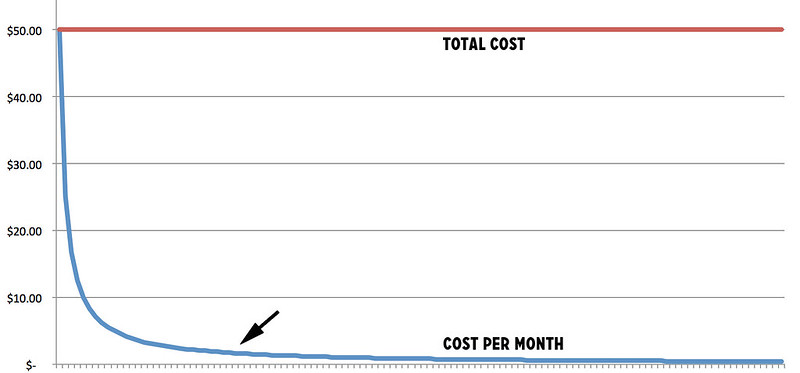

In 1992, Duane was the person who introduced me to mutual funds. He convinced me to set up an automatic investment plan into some Invesco funds. I contributed $50 per month to five different funds, for a total of $250 per month. That lasted for four months until I cashed out to buy a new computer.

Duane introduced me to a variety of money books, most notably The Only Investment Guide You'll Ever Need by Andrew Tobias. He taught me a ton of other lessons about life and money, some of which I've shared here at Get Rich Slowly over the years. (The Duane story I most often mention includes this lesson: “It's not bad to want things…It's not want that's the problem, but the habit of constantly satisfying wants.”)

During our walk on the beach, Duane gave me the news that I'd been dreading. “My cancer is back,” he said. “I've been doing immunotherapy.”

“What's immunotherapy?” I asked.

“Well, it's an attempt to stimulate the body's immune system to fight the cancer. With chemotherapy, the drugs are fight the cancer. Immunotherapy is a newer treatment and its effects less well known. It's not as harsh as chemotherapy, but it's also not usually as effective.”

“How is it working for you?” I asked.

“It's too soon to tell,” Duane said. “But so far I'm hopeful, and so are the doctors.”

I wanted to ask what his prognosis was, but was afraid to ask. I thought maybe he'd volunteer the info. He didn't. Finally, several hours later as we were driving home, I got up the courage to ask.

“What do the doctors have to tell you about your current situation?” I asked. For some reason, whenever I talk about Duane's cancer, I call it his “situation”.

“Honestly, it's not good,” he said. “At the end of June, they told me I probably had three to six months left to live.”

“Holy shit,” I said as I did the math in my head.

“Yeah. It doesn't look like I have much time left,” Duane said.

The Farewell Tour

“So, I've been thinking,” Duane said as we reached the outskirts of Portland. “I'd really like to go to Europe this winter. I want to see the Christmas markets in Vienna and Prague. Assuming I make it to December, of course. Do you want to come with me?”

“Of course,” I said. “You let me know when and where, and I'll make it happen.”

I was thinking of all of the times Paul had asked me to do things with him and all of the times I'd said no. I didn't have the money then, and I didn't have the perspective of age. Now I have both.

Later that evening, I talked to Kim about Duane's situation. “Duane is one of my best friends,” I said. “He's being pragmatic about his situation and so am I, but that doesn't mean I'm not torn up about it. I want to spend as much time with him as I can before he dies.”

“I totally support that,” Kim said. “You do what you have to do, and we'll figure it out.”

Last week, Duane and I met for lunch. He's now at the end of his fourth month of “borrowed time”. Honestly, he looks and sounds great. But I can tell that The End is weighing heavy on his mind. “Do you still want to make the trip to Europe?” I asked.

“Absolutely!” he said. “My brother and his wife plan to join us. And their daughter and her husband. There'll be six of us.”

Over the past week, we've been sorting out details.

- I booked a moderately expensive round-trip flight to Berlin. (Moderately expensive because I'm being fussy. I only want one layover. I want the flights to be short as possible. I have a limited set of dates on which I'll fly.)

- Duane and his niece picked the cities we'll visit: Vienna, Prague, and Budapest. She made a list of potential AirBNB rentals. Yesterday, I booked lodging for the six of us.

- After everyone else has flown home, Duane and I will fart around Germany without any real direction or plans — just like we did in Turkey.

There's a part of me that wonders if Duane will be healthy enough to travel in five weeks. (I let him proof this post. When he did, he expressed the same concern.) Again, he looks great now, and he's continued to defy the odds over the past eighteen months. (He recently ran the numbers for me based on the survival rate for various stages of his cancer. I can't remember the exact figure, but he's already lived longer than something like 98% of people in his situation.) But I worry what might happen before the trip.

When my own father was diagnosed with cancer in 1989, he was given six months to live. He lived another six years. It's my deepest hope that Duane too will fight that long, but I'm also trying to be realistic about his situation. I think he is too. In many ways, this trip to Europe is a sort of farewell tour.

Time Is More Valuable Than Money

When all is said and done, this trip will cost each of us several thousand dollars. Under normal circumstances, that's a lot of money. In this case, it seems like peanuts.

My friend Grant Sabatier has a book coming out in early February. It's called Financial Freedom. I read it last weekend so that I could provide a blurb. (It's good! You should check it out when it's available.)

“If some ninety-year-old rich dude offered you $100 million to trade places with him, would you do it?” Grant writes at the start of the second chapter. “Of course not. Why? Because time is more valuable than money.”

You can always make more money…but you can't make more time.

This is not permission to spend lavishly on anything and everything just because you might get hit by a truck tomorrow. It is, however, an invitation to consider what's important to you and to focus on that. It's encouragement to get clear on your personal mission statement and to build your life around it.

Over the past few months, Duane has made a superhuman effort to spend time with his family and friends. This time together is important to him. More than that, I think that he knows it's important to us, the ones he'll leave behind. We love him. We don't want him to die — but we cannot control that. All we can control is the time we spend with him today. All we can do is build more memories.

Here's another anecdote I like.

Duane and I went shopping after our lunch date last week. We stopped at the Icebreaker store to look at expensive wool shirts for our trip to Europe.

“I have a curious relationship with money now,” Duane told me as he held up a $130 shirt. “I can't take it with me, so what does it matter if I spend it? If I want a $130 shirt, I'm going to buy a $130 shirt — even if I only get to wear it once or twice.”

Duane did not buy that $130 shirt. Duane is a frugal fellow. I don't think he could buy a $130 shirt even if he tried!

The post Time is more valuable than money appeared first on Get Rich Slowly.

from Get Rich Slowly https://ift.tt/2RpjflC