Learning how to save money is a big part of living a Rich Life.

And contrary to popular belief, it isn’t just aimlessly tucking money away in a savings account or under your bed. It’s about:

- Good goal setting

- Practical systems

- Human psychology

Knowing how to save money allows us to invest in the things we want in the future (e.g., college tuition for your kids, a down payment on a home, wedding expenses). These are what we call Big Wins — and they’re the backbone of why we save money.

I want to show you some of the biggest wins you can earn after learning how to save money now.

- How to save money with 7 wins

- Money saving win #1: Automation

- Money saving win #2: Negotiation

- Money saving win #3: The A La Carte Method

- Money saving win #4: Lower your rent

- Money saving win #5: Prepay your debt

- Money saving win #6: The envelope method

- Money saving win #7: Use a sub-savings account

- 10-year savings strategy

- Next steps: The 7 big wins

How to save money with 7 wins

Without a doubt, the two biggest game changers when it comes to saving money are:

- Automating your finances. Eliminate the stress of figuring out what to do with your savings

- Earning the Big Wins. It’s way easier to earn an extra $30 a day than to save $3/day

When you automate your finances and focus on the Big Wins, you’ll see explosive growth in your savings and earnings almost instantly. And the best part: You can do all these things in a few hours and then you never have to think about them again.

Here are seven money saving wins that incorporate one or both of those aspects.

Money saving win #1: Automate your finances

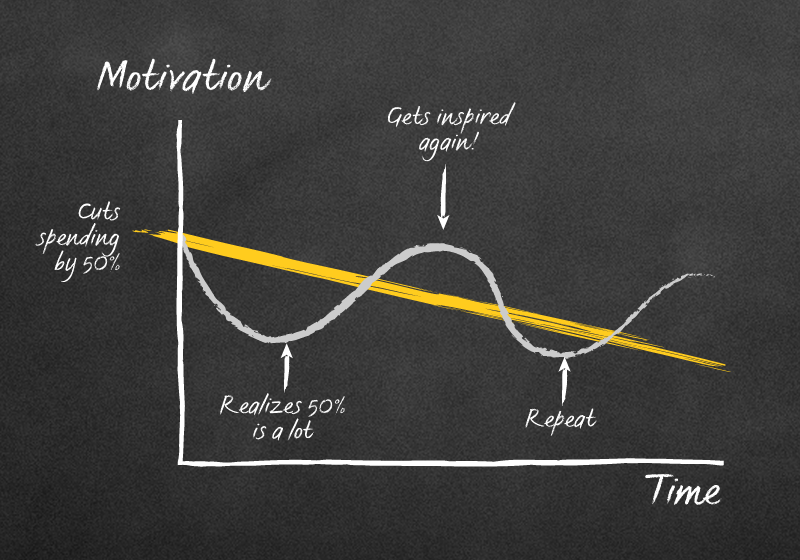

One reason we don’t regularly save money is due to the pain of putting money into our savings accounts each month.

It’s the reason why cutting out lattes or skipping lunch is a terrible way to save more money.

And so, just like cutting out luscious, perfectly foamed lattes, we might put away money for savings once or twice — but if we have to make the decision EVERY paycheck, we’re setting ourselves up to fail.

That’s why automated finances work so well. You can start to dominate your finances by having your system passively do the right thing for you. Instead of thinking about saving every day — set it and forget it.

To do this, you need just one hour today to follow these steps:

Step 1: Set up your bills so they’re sent to you on the 1st of the month

This is assuming you’re being paid on the first of the month. If not, just adjust the day accordingly.

Call your credit card, electric company, internet service provider, Netflix, whatever, and have them bill you on that date. This streamlines the process and allows you to know when exactly your bills need to be paid.

There may be a couple of months of odd billing as your accounts adjust, but it will smooth itself out after that.

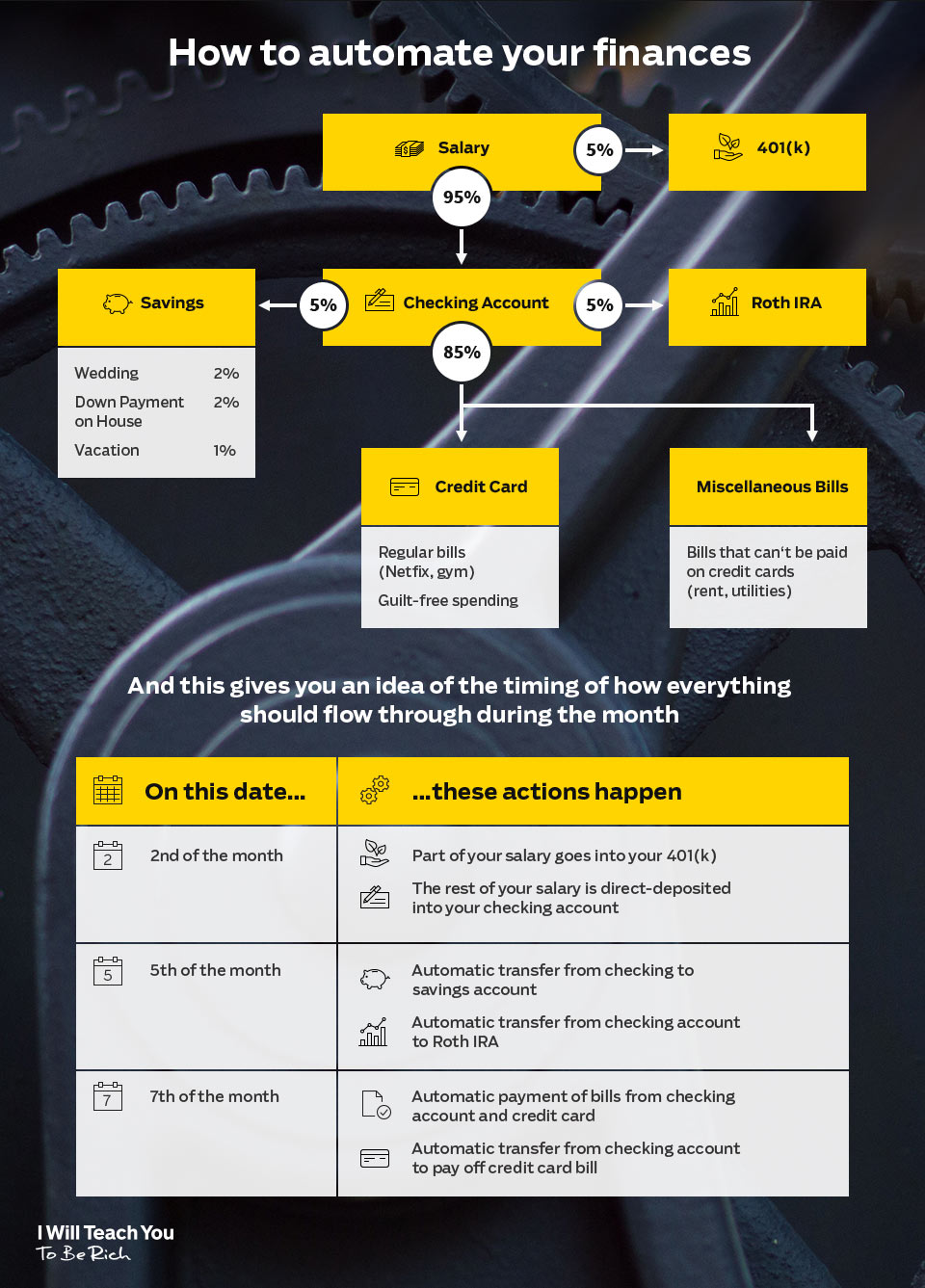

Step 2: Set up your contributions to your 401k

Before your paycheck even arrives into your checking account, make sure that you have your 401k plan set up with your employer and that you’re at least putting in enough money to collect the employer match. It means that for every (pre-tax!) dollar you contribute your company will match that amount up to a certain percentage.

This ensures that you’re taking full advantage of what is essentially free money from your employer. Let them help you save more money for retirement.

For more on 401ks, be sure to check out my article on retirement accounts. For now, it’s time to move onto step three …

Step 3: Automate your checking account

Once your paycheck actually arrives into your checking account, the money will now go into 4 different places:

- Roth IRA: Like your 401k, you’re going to want to max it out as much as possible. The amount you are allowed to contribute goes up occasionally. Currently, you can contribute up to $5,500 each year.

- Savings account: Here, you should use “sub-saving accounts” for long-term goals like your wedding, vacation, or down payment on your house (more on this later). Many banks provide the option to create smaller sub-accounts in your normal savings account — perfect for goal setting.

- Credit card: Make automatic payments for recurring services like Netflix, Birchbox, and gym memberships using your credit card. Also, if you’re maxing out your 401k and Roth IRA, you’re going to have plenty of guilt-free spending money in here for things like the occasional night out or fun purchases you want to make.

Log into your credit card’s website and set up automatic payments with your checking account so your credit card bill is paid off each month. You can rest assured that you will have enough money in your checking because you’ve already set up automatic payments with everything else.

- Misc. bills: These are for bills that can’t be paid off with a credit card such as rent, electric, water, and gas.

Set it up so that your checking account automatically sends funds to these four areas on your bank’s website — or you can just call your bank and have them do it for you. Or you could go to the bank in person, sort out your accounts and make a new friend.

For a more detailed explanation, you can check out my 12-minute video on how to automate your finances here.

Money saving win #2: Negotiate your bills

Once you have your finances automated, the next step in learning how to save money is to negotiate for lower prices on your bills.

It’s a little-known fact that you can negotiate many of your bills with a one-time phone call. In fact, you can save HUNDREDS a month on bills for your:

- Car insurance

- Cell phone plan

- Gym membership (less likely but still possible)

- Cable

- Credit card

It’s simple too. There are only three things you need to do to negotiate with these companies on fees and rates:

- Call them up.

- Tell them, “I’m a great customer, and I’d hate to have to leave because of a simple money issue.”

- Ask, “What can you do for me to lower my rates?”

Of course, you’re going to want to adjust this formula for whatever company you’re calling. Check out my video on negotiating your bills for more on this topic.

Money saving win #3: Implement the A La Carte Method

This is a GREAT method to save money on services for which you have a subscription, like:

- Netflix

- Gym memberships

- Spotify

- Amazon Prime

- Magazines

“But Ramit, how am I supposed to give up my Netflix account or Amazon Prime?!”

Well, chances are you’re WAY overpaying for these things anyway.

In fact, a conservative estimate shows that we spend over $1,800/year on subscriptions alone.

The convenience is undeniable — subscriptions are a fantastic way to automate our lives.

BUT in this case the automation is working for THEM and not for YOU.

When was the last time you scrutinized your monthly subscriptions and canceled one?

Probably never. Yet compare this to any time you went out shopping, saw something you liked, but didn’t buy it.

Read that again. It’s the key to cutting your spending through your subscription items you’re probably not getting very much value out of.

Which is why I suggest the A La Carte Method.

The basic idea of this system is to cancel all your discretionary subscriptions — magazines, Spotify, Netflix — and buy what you need a la carte.

- Instead of paying for a ton of movies and shows you’ll never watch on Netflix, buy only the shows you want to watch on Amazon or iTunes for $1.99.

- Buy a day pass for the gym each time you go (around $5 – $10).

- Buy songs as you want from Amazon or iTunes for $0.99 each.

This FORCES you to be conscious with your spending — like my friend who spends $21,000 a year going out. By utilizing the same principles that make automating your finances great, you will have to actively think about each charge you make when it comes to buying a song or TV show.

Of course, this isn’t for everyone. I encourage you to use this if you find yourself short on cash and wondering why you can’t save more money each month.

If after about two months, you find yourself spending enough money on these items to justify the subscription, by all means pick it up again. If not, then you’ve saved yourself some major cash.

Money saving win #4: Lower your rent

Your rent is NOT fixed and beyond negotiation. Like your bills, rent can be negotiated and lowered too. This is one of the biggest misconceptions there is to renting.

The key to that is going into it with the right mindset and preparation.

Here are five steps you can start taking today to lower your rent:

Step 1: Determine the exact rent reduction you want

Before you even call up your landlord, make sure you have a goal in mind — whether it be a certain price or percentage you would like to see negotiated.

When you know what you want, not only can you communicate that crisply to your landlord, but you can also demonstrate WHY they should accept less.

Step 2: Have something ready in return

You can’t just tell your landlord “I want to take $200 per month off my rent” and expect them NOT to laugh in your face … you have to be ready to offer something in return.

Why would your landlord benefit from your lowered rent?

Here are a few things many landlords will happily lower rents for:

- Prepay months in advance

- Sign an extended lease

- Offer to extend the termination notice from 30 days to 60 or 90 days

- Offer to give up your parking space if you don’t have a car

- Promise not to smoke in the apartment thereby saving the landlord money when you move out

- Promise not to keep pets even if they’re allowed

- Make a deal for referrals if they have low occupancy

If you know what they want and can offer it to them, your chances of succeeding in negotiation increases significantly.

Step 3: Practice. Practice. Practice.

Meaning, if you’re new to negotiations, don’t try to go against a reluctant landlord — yet.

Negotiation is a skill, and like any other skill, you need to practice to get good at it. I suggest you negotiate your credit card and bills before tackling this.

Once you’re ready, you can get my word-for-word rent negotiation scripts here.

Money saving win #5: Prepay your debt to save thousands

If you have student loans, you can actually save thousands of dollars each year — by spending more each month.

“Uh, Ramit. How can I possibly save more by spending more?”

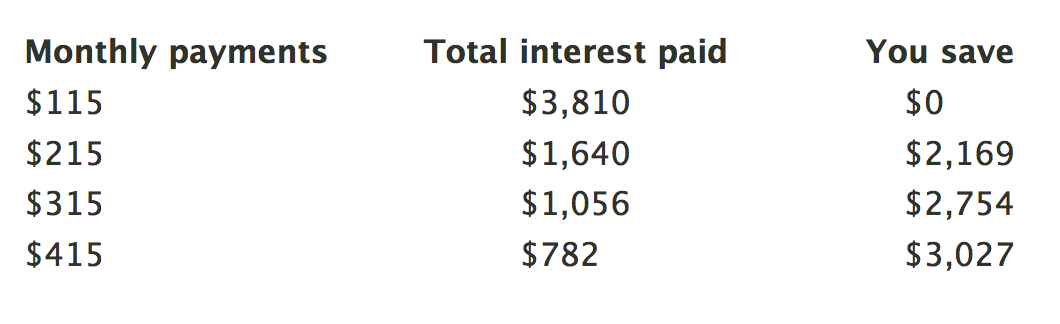

Well let’s say you have a $10,000 student loan, at a 6.8% interest rate and a 10-year repayment period.

If you go with the standard monthly payment, you’ll pay around $115/month.

But check out how much you can save per year if you paid just $100 more each month:

Even prepaying $20 more per month can save you HUGE amounts of money.

If you can prepay even a small amount more per month, the benefits can be significant. See for yourself by calculating your savings using this calculator.

Money saving win #6: The envelope method

The envelope system is a great way to be more conscious about your spending.

It works by putting physical cash for all your monthly expenses (e.g., gas, going out, shopping) into dedicated envelopes.

For example, you might have an envelope for “Restaurants,” so everytime you go out to eat you’ll take money from it to spend. Once you’ve used all the money in the envelope, you’re finished for the month!

This method is flexible in terms of being able to dip into other envelopes if there’s an emergency. However, there’ll be less money to spend for the month on that category of expenses.

You don’t need to use physical envelopes either. One of my friends who started tracking her spending a while back had a great system: She set up a separate bank account with a debit card.

At the beginning of each month, she transferred around $200 in it. So when she goes out, she spends that money. And when it’s gone, it’s gone. It’s a fantastic system that helps her be conscious of what she spends.

Whatever system you decide to use, you just need to make sure to decide how much you’re willing to spend in each category (and that’s all up to you).

You can set up your envelope system in three steps:

- Decide how much you want to spend in each major category each month.

- Put money into each envelope (e.g., $200 for groceries, $150 for eating out, $60 for entertainment).

- Spend the money — but when the envelopes are empty, that’s it for the month.

If you set up a debit account, be sure to call your bank and tell them you DON’T want them to allow you to spend more than you have in your account (this is known as overdraft protection). If you don’t do this, you might run into a ton of overdraft fees.

(By the way: If you do slip up and find yourself slapped with some fees, here’s a handy guide for getting them waived.)

Money saving win #7: Use sub-savings accounts

Sub-savings accounts are some of my favorite ways to save money for any purchase.

These are accounts that you can create along with your normal sub-savings account — but dedicate them to specific purchases.

That means:

- Putting money away towards your savings goals

- Saving cash when you automate your finances

I remember when I first found sub-savings accounts, it was like the heavens opened up and “Hallelujah” started playing. I made one and named it “Down Payment” so I could save for a down payment on a house.

Over the months, the money I saved in the account grew bigger and bigger and I felt really proud of that.

While I did this, a buddy of mine was also saving — BUT he was just putting away cash blindly into an account he hadn’t dedicated to anything.

Though we might have had the same amount saved away, the difference between us psychologically was staggering. Where he felt despair about trying to save money, I was motivated.

For me, I wasn’t working towards $20,000 for a down payment. I was working on saving $333 a month over five years — a perfectly achievable goal, especially after I tracked my progress.

Eventually, my friend did open up his own sub-savings account. He told me that doing so changed his entire perspective on saving money for the better.

Go to your bank’s website and open up a sub-savings account. You can even name it to reflect whatever it is you’re saving up for.

Once you do that, be sure to automate your finances so you’re passively putting money into it each month.

What’s next?

So you have all the savings basics nailed down — automating your finances, lowering your bills, negotiating your rent … what do you do next?

First off, congratulations!

You’re ahead of 90% of your peers when it comes to your personal finance. But that doesn’t mean you should get complacent.

In fact, from here I’d suggest doing two things:

- Set up a 10-year savings strategy

- Focus on Big Wins

10-year savings strategy

This is the next level of saving — the one that’ll take you from amateur penny-pincher to pro-saver. Once you’ve gotten the basics taken care of, you can now start implementing a 10-year strategy.

This involves asking people 10 years older than you what they wish they’d saved for — and start saving for it.

This sounds obvious, but it actually requires admitting that — despite your superior financial acumen — you’re still going to have the same expenses as everyone else.

Yeah, it’s nice to imagine you’re going to be a millionaire one day, sipping piña coladas from a beach while your investments make money for you … but reality will be ready to smack you upside the head with things like:

- Wedding expenses: And don’t even begin trying to tell me something like “I just want to have a small simple wedding.” Shut up. Your wedding will be nice and it will be expensive like everyone else’s.

- Kids and their expenses: If you plan on having a child one day, you can bet you’re dropping A LOT of money on them.

- Down payment on a house: You’re definitely gonna want to save for this if you plan on owning a home one day.

Remember when I talked about sub-accounts in your main savings accounts? Well, you’re going to start setting up sub-accounts for any and all of these goals.

Then you’re going to automate your checking account so it sends funds into the accounts as soon as you receive your paycheck.

This may seem simple — and it is — but you can’t just scoff at this for being too easy and do nothing. I challenge you to consciously choose 1 of 3 options for this today:

- I’m going to do this within the week

- I’m not going to do this because I’m going to do another strategy within the week

- I’m not at this stage yet … I’m going to pick up your book (or another book, or just do it) and get there

Next steps: The 7 Big Wins

Next time you hear the same old tired advice on saving money — keeping a budget, or cutting back on $3 lattes — ask yourself: Has that really worked for the millions of people who’ve tried it?

Are they really not “trying hard enough”?

Or is there perhaps a systemic problem urging people to waste their limited willpower on near-meaningless tasks with little reward?

Should we instead focus on high-leverage areas that will result in massive payoffs?

There are just a few Big Wins in life where — if you simply get them right — you almost never have to worry about the small things. If you can focus on the 5-7 Big Wins, rather than 50 little things, you can have an insurmountable edge in life.

Here are the 7 wins I suggest you tackle ASAP — and we’ve already covered a few of them.

- Automate your finances

- Start investing early

- Improve your credit score

- Land your Dream Job

- Negotiate a raise

- Make money on the side

- Negotiate your rent

Put another way — how can we focus on using Big Wins so we can save money … AND get on with doing the things we truly love?

For your first Big Win, I want to give something to you: My Ultimate Guide to Personal Finance.

Along with the things you learned in this article, I’ll also show you my systems for earning and investing your money. Just enter your name and email below and I’ll send it straight to your inbox for FREE.

How to save money with 7 savings wins is a post from: I Will Teach You To Be Rich.

from I Will Teach You To Be Rich https://ift.tt/2uGLXDc

#money #finance #investing #becomerich