Being a copywriter is AWESOME.

You get to jet around the world, eat in the finest restaurants, and date supermodels.

Totally legit text exchange I had recently.

Okay, maybe it’s not THAT extravagant — but being a copywriter is still great. You make a good amount of money while flexing creative muscles you wouldn’t be able to otherwise.

The best part: You also don’t need any formal education. In fact, some of the most sought after and highest paid copywriters in the world never took a writing class in their life and clear six figures a year.

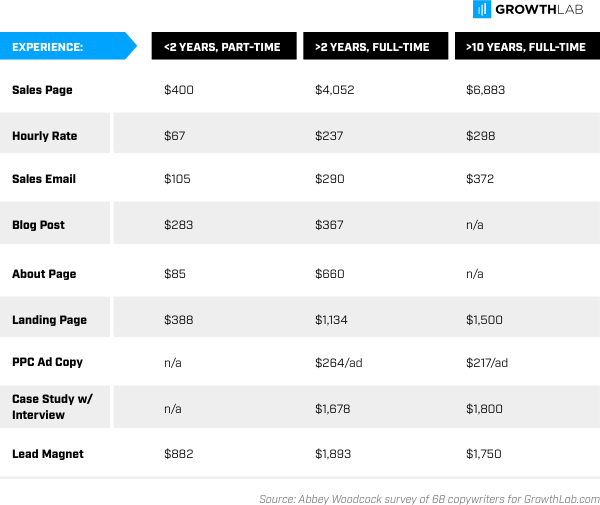

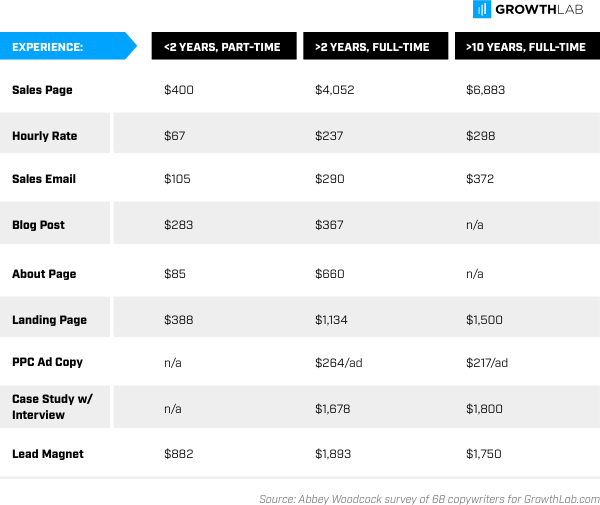

Check out these rates that copywriters charge:

From our sister site GrowthLab.

A relatively new part-time copywriter can make $283 from just ONE blog post. The best part? It’s easily scalable, meaning you can earn even more if you have the right systems.

I’m going to show you how.

- What is a copywriter

- The two paths: Freelance and in-house

- How to become a copywriter

- Earn more money today

What is a copywriter?

A copywriter is anyone who is paid to write copy — aka the words used for marketing products and/or services. This includes things like:

- Sales pages

- Email funnels

- Landing pages

- Blog posts / articles

- Social media posts

- White papers

- Case studies

Despite the name, copywriters are more than just writers. They’re writers, salespeople, and behavioral psychologists all rolled into one. To be a good copywriter, you need to learn to master all those elements.

Luckily, it’s easy to start getting the experience you need.

The two paths: In-house and freelance

There are two ways you can start getting experience as a copywriter:

- In-house. Working for a company or marketing agency.

- Freelance. Working as a freelance copywriter (aka being your own boss).

And both have their pros and cons.

IN-HOUSE COPYWRITING

|

IN-HOUSE PROS |

IN-HOUSE CONS |

|

|

|

|

|

|

|

|

FREELANCE COPYWRITING

|

FREELANCE PROS |

FREELANCE CONS |

|

|

|

|

|

|

|

|

If you want to learn more about getting an in-house copywriting job, be sure to check out our best resources on finding your dream job.

For this post, I’m going to focus on creating your own freelance copywriting hustle — even if you have no experience.

How to become a copywriter (even with zero experience)

The art of writing (and doing it well) is one you’ll learn with experience — so you might not be great at it if you’re just starting out at first.

To help offset the steep learning curve, though, here are some fantastic resources on copywriting from our sister site GrowthLab:

- 20 copywriting books you need on your shelf

- How to write copy

- The 6-part outline every good sales page has in common

- How a $100,000 sales page is made

- The Ultimate Guide to Remarkable Content (This is from our sister site I Will Teach)

- The Ultimate Guide to Email Copywriting

The good news is the more you do copywriting, the better you’ll get. So let’s get started on the four steps to becoming a freelance copywriter.

Step 1: Define your copy niche

Before you start looking for clients, before you start putting pen to paper (or fingers to keyboard?), before you do anything at all, you need to first define your niche.

This is the specific area and audience you’re going to target as a copywriter.

“But why would I want to limit myself? Wouldn’t I get more work if I open myself up to more people?”

It’s paradoxical — but you’ll actually be able to find more work AND charge more if you niche down your audience and specialization.

Imagine there are two fitness coaches. Which one do you think gets more business?

- The coach who says that he’ll help anyone feel and look better

- The coach who only works with middle-aged men to get six-pack abs

The answer is the second one! That’s because that coach is specialized. He knows who his clients are and offers a clear goal: To get six-pack abs. As such, he’ll attract more customers.

A few niche copywriters for inspiration:

- VeryGoodCopy. Eddie gears his copywriting to helping SaaS companies craft … well, very good copy.

- SusanGreenCopywriter. Susan helps nonprofits gain more funding through their copy.

- TheGymCopywriter. Gyms aren’t all about lifting and getting swole — they’re also about high-performing copy techniques.

So first, think about what role you want to own — and there are a lot of them.

- Emails / Sales funnels

- Social media / Community management

- Search engine optimization (SEO)

- Blog posts / Articles

- Video / Podcast scripts

There’s no right answer here. The important thing is you pick what’s interesting to you and get started. And you can always change it later if it’s not a right fit.

Now you’re going to niche down your target market.

This will be your prospective clients. Ask yourself:

- What industry are they in?

- What are their services?

- How do they use copy currently?

Once you have the answer to those questions, you can come up with your niched-down role.

Here are a few examples:

- Email funnel copywriter for SaaS companies

- Social media manager for nonprofits

- Blog posts for personal finance websites

Once you know how you want to approach your copywriting hustle, it’s time to find your first clients.

Step 2: Find your first client

Finding clients can be a little intimidating — especially when you’re new.

Luckily, once you find your first few clients, the process becomes MUCH simpler, since they’re likely to refer you to their network (more on this later).

There are a lot of different ways you can find your first client. And you already have a lot of different platforms to find work as a copywriter.

One of the most popular: Upwork, a job and gig site catered toward freelancers.

Getting started with the website is simple. You simply create a freelancer profile and start applying for various projects on the site such as copywriting, SEO, social media, and more.

It should be noted that while Upwork can be a great place to find clients and build a portfolio, you shouldn’t necessarily rely on it to find all of your clients.

Instead, we suggest you go to where your clients live. This means going to message boards, forums, and websites your client might frequent and be incredibly helpful.

It’s what Luisa Zhou, entrepreneur and writer for GrowthLab, did to help her earn $1.1M in eleven months.

From Luisa:

I started spending all my free time hanging out where my potential clients were online (free Facebook groups) and directly engaging with them by sharing valuable content and answering any questions I could about advertising.

That’s how I got my first client. A woman I’d been helping for free — answering her questions about how to set up a basic advertising campaign — asked me how she could work with me, and when I told her the price — $5,000 for six months — she said, without missing a beat, “I’m in.”

You can apply the same framework for your potential clients:

- Are you a graphic designer? Find a Facebook or subreddit group for small business owners who need your services.

- Are you a writer for a niche industry? Start answering questions on Quora regarding your niche.

- Maybe you’re a video editor. Find online groups for bloggers looking to expand their content media.

Start going to these places and providing value. Not only that, but you should be doing it consistently. I’m talking on there every day for AT LEAST one hour a day.

By being engaged and providing immense value, you’ll build a network of clients organically and develop a rock steady reputation.

Step 3: Know what to charge

This is the part where most freelance copywriters get tripped up. That’s because there’s no official rate for your services.

Like many things freelancing, though, you need to remember not to worry too much about it when you’re starting out.

In fact, you can even work for FREE if you do it strategically.

Some good examples when it’s okay to work for free:

- You’re building a portfolio of work you can show to future paying clients

- You want to build connections with businesses you admire

- The person you want to work for is well-connected. And if you do a good job, they’ll connect you with other people

- You already have a full-time job so you can afford to trade time for experience

This is something I’ve done when I was starting out as a freelance copywriter AND it’s something that Ramit has done many times before.

This flexibility is key to any freelance marketer starting out.

Of course, you’re going to want to eventually charge, you know, actual money.

To help, we have four different pricing models you can use to base your rates off of:

- Hourly. You set an hourly rate and a client will pay you per hour. The benefit for the client is that they mitigate their risk since they can just stop paying you whenever they want if they’re dissatisfied. It also stops the clients from piling on work without paying you.

- By project. You’ll know exactly what you’re getting paid for an entire project, with more concrete deliverables for the client. This method is nice because when you’re done with the project, you’re done. So you might end up getting paid more than your hourly rate. However, you do run the risk of the client adding more work onto the project as you move along, so communication about what a “project” entails is important.

- By retainer. Your client will pay you a set amount monthly. This allows the client to have access to you at any given time during that month. As a beginner, you’re probably not going to find a client who is willing to hire you on retainer until you’ve built up enough experience working with them. However, it’s a good goal to have and something to keep in mind as you get into freelance marketing.

- Commision/bonus. This payment model can work in conjunction with all of the other ones and can provide a healthy incentive for you to get your work done. For instance, if your client promises you a $1,000 bonus for attaining X amount of leads with your landing pages.

If you’re a beginner, I suggest you charge hourly, because most clients are going to be unsure about whether or not you’ll be able to do a good job. As such, they might not want to give you a fat project fee.

Once you’ve gotten your first three or so clients though, then you can move on to different pricing models.

And when it comes to how much exactly you should be charging, there’s no right answer.

However, we here at IWT have a few solid rules of thumb that can help you ballpark a good rate:

- Drop Three Zeros Method

Simply take your ideal (read: realistic) salary, drop three zeros from it, and voila, you have your hourly rate!

For example, say you’d really like to earn at least $40,000. Just take the three zeros from the end and you now have your rate: $40/hour.

- Double your “resentment number”

I love this one because it’s both really interesting and effective. Ask yourself: What’s the lowest rate you’ll work for that’ll leave you resentful of your work?

Say you’ll work for $15/hour at the VERY LEAST. Just double that number so now you’ll earn $30/hour.

- Do what the next guy does

Go to Google and search for the average hourly rate for whatever service you’re providing. You’ll get a good sense of where to start when you’re charging your clients.

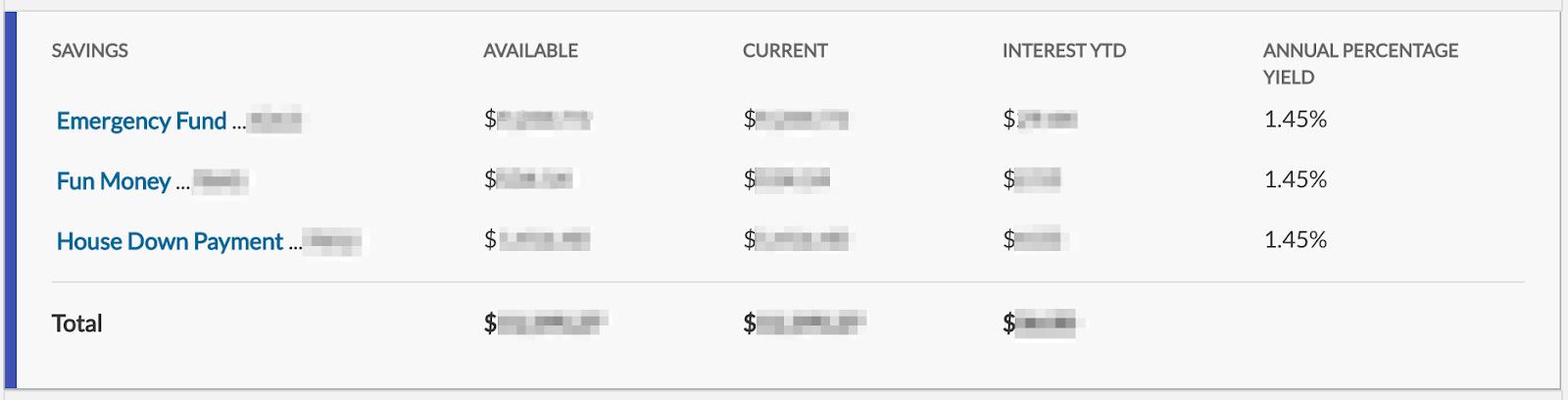

If you need even MORE help, here’s that handy chart from professional copywriter Abbey Woodcock. She surveyed 68 copywriters for GrowthLab to find out how much they charged:

What do you notice about the rates above?

First, there’s a HUGE disparity between a highly experienced copywriter and a beginner copywriter. This should be encouraging for anyone just getting started.

Also, even when you’re a relative beginner, you’re still making a good amount of money for your services. Say you write an “About” page for a company and charge $85. If that “About” page only took you an hour to write, that’s a fantastic ROI on the time spent.

Of course, you don’t want to just charge the same rate forever. Which is why, when you get more and more experience, you’re going to want to scale.

Step 4: Scale

Scaling means growing your copywriting hustle to earn more and get more clients.

And the best way to do this is through referrals. These are potential clients that you get from existing clients.

When your current client refers your copywriting services to another business, that’s a referral.

They’re incredibly valuable for a few reasons:

- You can raise your prices when you get a referral. The client who referred you has automatically added value to your work by recommending you. That means you can charge more for your work.

- You get better clients. When you charge more, you’ll start attracting high-quality clients who can afford you. They’re also much less likely to waste your time if you’re being paid top dollar. It’s a win all around.

- You can more than double your income. Check out this case study from a freelance project manager who went from charging $25/hour to $75/hour just by getting a referral. This is a HUGE win.

And asking for referrals is easy — if you have the right script.

Luckily, we have a proven script from our article on how to get clients to help you ask for referrals:

CLIENT’S NAME,

I’m so happy to hear that you enjoyed my work. If you know of anyone else who’s looking for my services as well, I’d be grateful if you passed my contact information along to them.

Thank you,

YOUR NAME

It’s simple, direct, and gets results. Over time, you’ll start getting so many referrals you’ll have to deny some prospective clients — which is an awesome problem to have.

Earn more money today

If you’re really interested in making money as a freelance copywriter, we here at IWT have a gift for you: The Ultimate Guide to Making Money.

In it, we’ve included our best strategies to:

- Create multiple income streams so you always have a consistent source of revenue

- Start your own business and escape the 9-to-5 for good

- Increase your income by thousands of dollars a year through side hustles like freelancing

Download a FREE copy of the Ultimate Guide today by entering your name and email below — and jump into freelance marketing today.

How to become a copywriter (even with zero experience) is a post from: I Will Teach You To Be Rich.

from I Will Teach You To Be Rich https://ift.tt/2tHnsXK

#money #finance #investing #becomerich

.

.