Here’s my investment portfolio:

Investments in a diversified portfolio are spread out among different asset classes. Within assets, investments are diversified even further (e.g., international vs. domestic equities). This is a solid example of a diversified portfolio.

BUT before you start trying to match my portfolio, you need to know one thing: My financial situation is, in all likelihood, VASTLY different from yours.

If you want your own diversified portfolio tailored to your specific financial situation, I can help you do that. I’ve helped thousands do it through my New York Times best-selling book already.

Let’s get started by taking a look at what being diversified actually means and how it can help protect you from the whims of the financial markets.

The importance of asset allocation and being diversified

Imagine two farmers: Olivia and Andrew.

Both are the same age and each has bought a hundred acres of farmland.

Andrew decides to grow corn (and only corn) on his land. He dedicates 100% of his acreage to the one crop. As such, his initial season brings him in a good amount of money since there are plenty of people who want corn.

Olivia also grows corn, but only dedicates 50% of her land to the crop. With her other acres she grows soybeans, alfalfa, and even a pumpkin patch (for the lattes, of course). Her initial season is profitable, but not as much as it’d be if she only sold corn.

But then comes a blight. This blight affects only corn crops, leaving them dried out and inedible.

Though half of Olivia’s crops die, she still has plenty of crops not affected by the blight. Things will be harder for her going into the next season, but she will be able to support herself.

Andrew, however, can only watch in dismay. All of his crops die along with his livelihood. He’s forced to move back to his parents’ house and finds a new “job” selling his hair online.

The difference between the two? Olivia diversified while Andrew didn’t.

This is what it means to diversify your portfolio — to vary your investments so you hedge your losses while maximizing your earning potential.

You can use asset allocation and diversification to do this.

This is how much money you invest into certain asset classes in your portfolio, the major ones being:

- Stocks and mutual funds (“equities”). When you own a company’s stock, you own part of that company. These are generally considered to be “riskier” because they can grow or shrink quickly. You can diversify that risk by owning mutual funds, which are essentially baskets of stocks.

- Bonds. These are like IOUs that you get from banks. You’re lending them money in exchange for interest over a fixed amount of time. These are generally considered “safer” because they have a fixed (if modest) rate of return.

- Cash. This includes liquid money and the money that you have in your checking and savings accounts.

Remember: These asset classes are just broad categories. For example, stocks actually include many different varieties such as large-cap stocks, mid-cap stocks, small-cap stocks, and international stocks.

And none of them perform consistently. For example, financial theorist William Bernstein once noted that U.S. large-cap stocks gained 28.6% while real estate stocks lost 17% in 1998…

…but just two years later, U.S. large-cap stocks lost 9.1% while real estate stocks gained 31.04%.

Similarly, different types of bonds offer different benefits including rates of return and tax advantages.

The fact that performance varies so much in every asset class means two things:

- If you’re investing to make money fast, you’re probably going to lose. This is because you have no idea what will happen in the near future. Anyone who tells you they do is lying.

- You should own a variety of assets in your portfolio. If you put all your money in U.S. small-cap stocks and they don’t perform well for a decade, that would really suck. Instead, if you owned small-cap, large-cap, with a variety of bonds, you’re more insured against one investment dragging you down.

Just like Farmer Andrew, you don’t want to devote all your land to one crop. That’s why you want your asset allocation in check by buying different types of stocks and funds to have a balanced portfolio — and then further diversifying in each of those asset classes.

A 1991 study discovered that 91.5% of the results from long-term portfolio performance came from how the investments were allocated. This means that asset allocation is CRUCIAL to how your portfolio performs.

Now that you know the basics of asset allocation and diversification, I’m going to give you one diversified portfolio example you can base your portfolio on AND give you a look into my own portfolio.

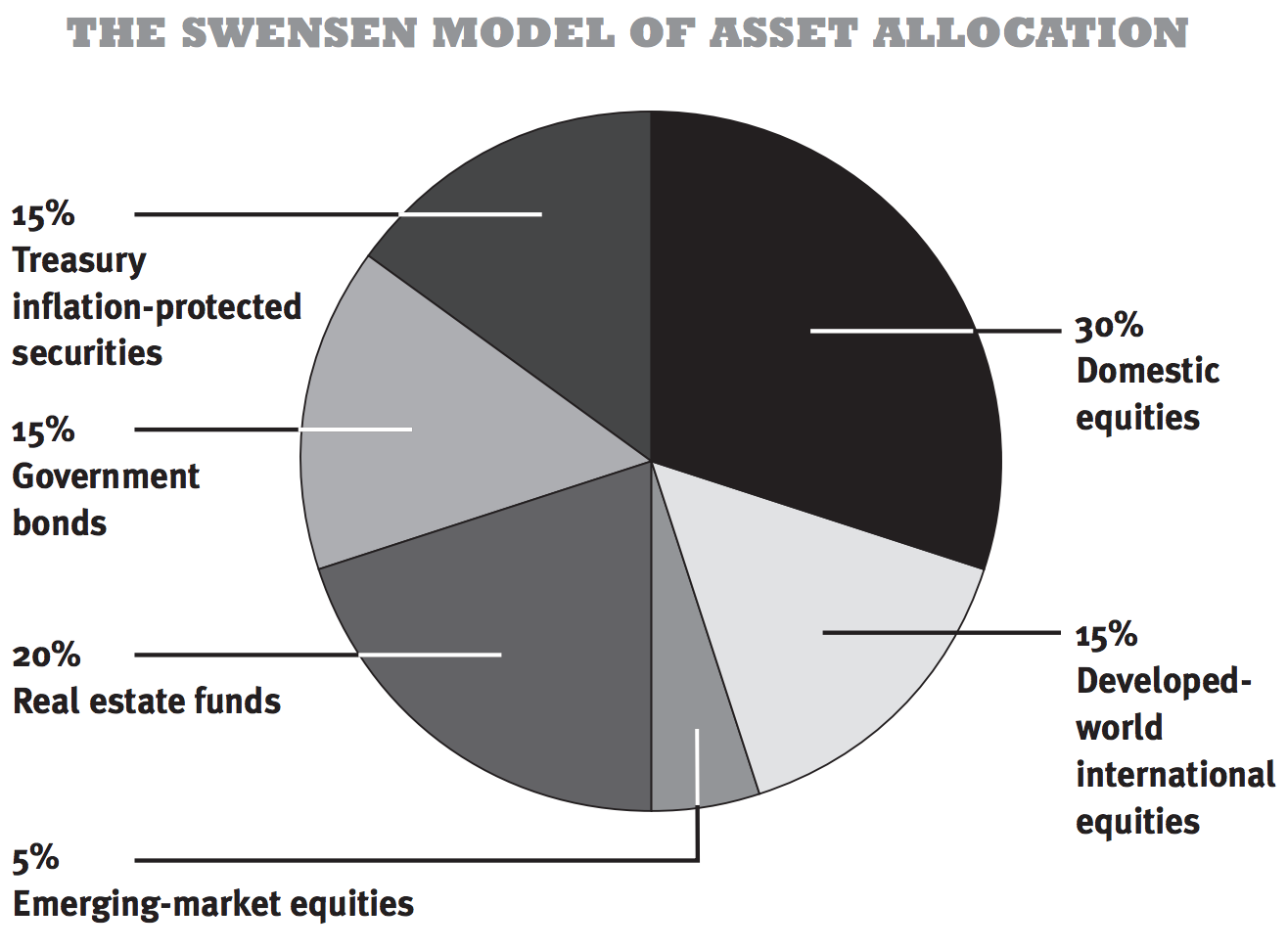

Diversified portfolio example #1: The Swensen Model

David Swensen runs Yale’s fabled endowment, and for more than 20 years he generated an astonishing 16.3% annualized return — while most managers can’t even beat 8%. That means he’s DOUBLED Yale’s money every four-and-a-half years from 1985 to today.

Best of all, Swensen is a genuinely good guy. He could be making hundreds of millions each year running his own fund on Wall Street. Instead, he chooses to stay at Yale, making just more than $1 million per year because he loves the school and academia.

“When I see colleagues of mine leave universities to do essentially the same thing they were doing but to get paid more, I am disappointed because there is a sense of mission,” he’s said.

I LOVE this guy.

Aside from being a total A-player for Yale, he also has an excellent suggestion for how you can allocate your money using the following model:

|

ASSET CLASS |

% BREAKDOWN |

|

Domestic equities |

30% |

|

Real estate funds |

20% |

|

Government bonds |

15% |

|

Developed-world international equities |

15% |

|

Treasury inflation-protected securities |

15% |

|

Emerging-market equities |

5% |

|

TOTAL |

100% |

What do you notice about this asset allocation?

No single choice represents an overwhelming part of the portfolio.

As illustrated by the tech bubble burst in 2001 and also the housing bubble burst of 2008, any sector can drop at any time. When it does, you don’t want it to drag your entire portfolio down with it. As we know, lower risk generally equals lower reward.

BUT the coolest thing about asset allocation is that you can actually reduce risk while maintaining a solid return. This is why Swensen’s model is a great one to base your portfolio on.

Now let’s take a look at a more advanced and handsome investor…

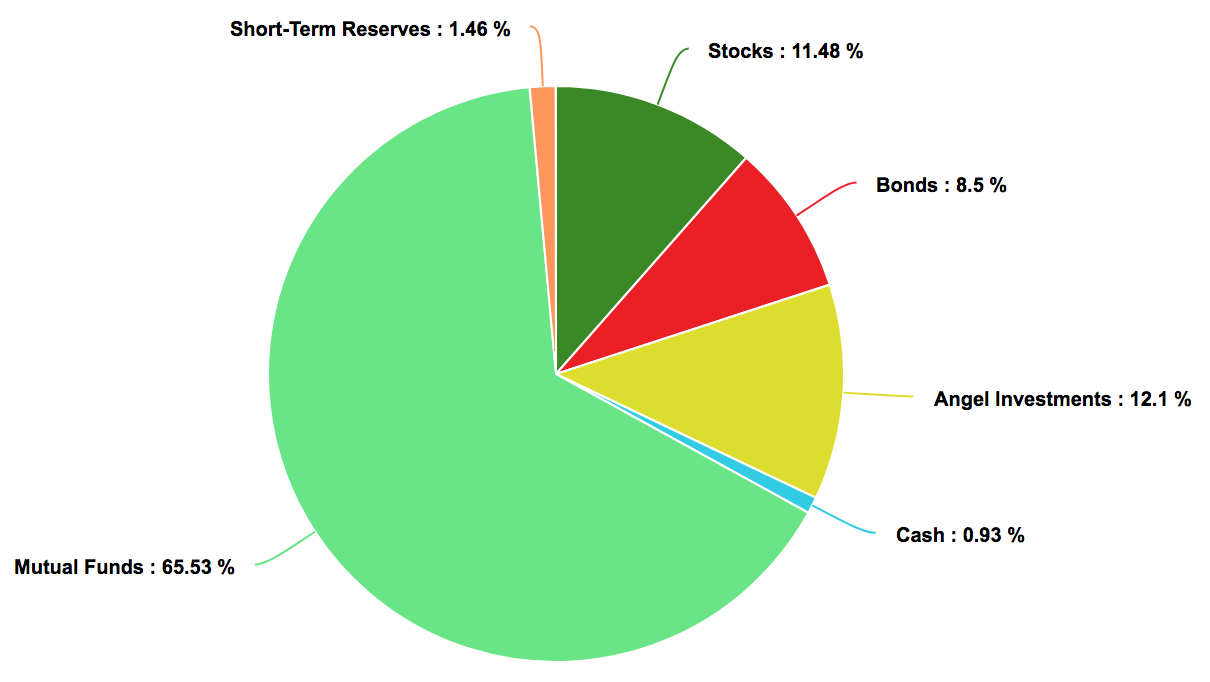

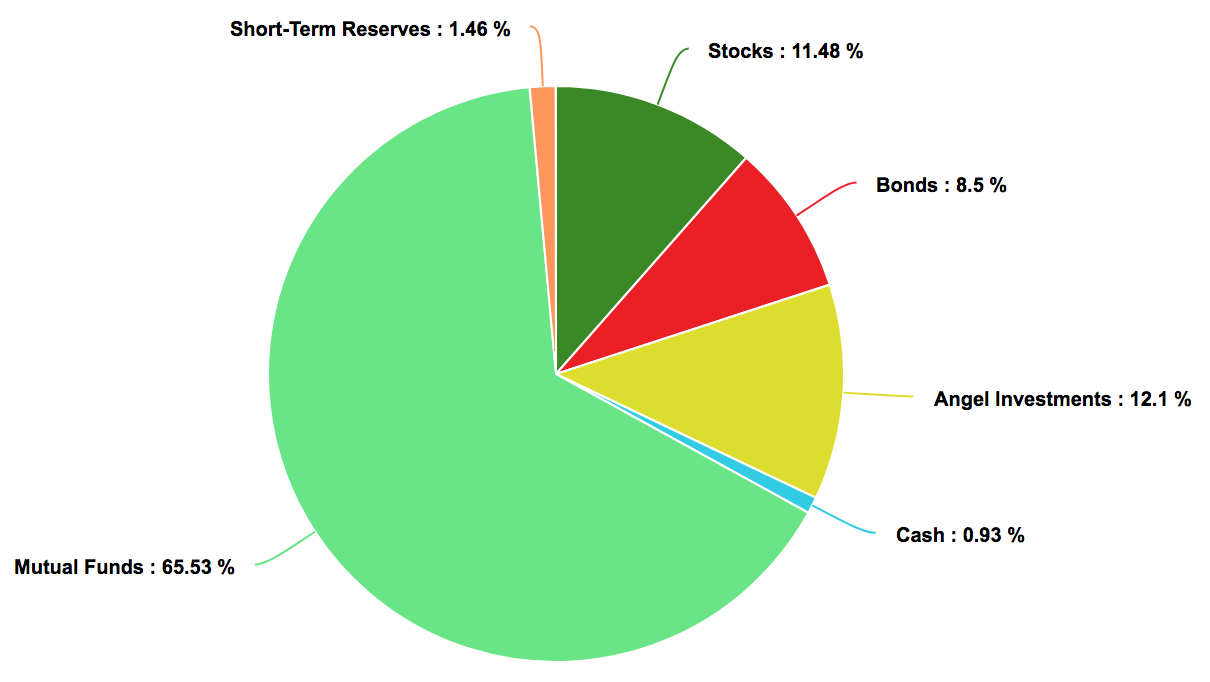

Diversified portfolio example #2: Ramit’s diversified portfolio example

This is my investment portfolio. I spent quite a while getting it right, but once it’s set, you don’t have to change it often.

The asset classes are broken down like this:

|

ASSET CLASS |

% BREAKDOWN |

|

Cash |

0.93% |

|

Angel investments |

12.10% |

|

Mutual funds |

65.53% |

|

Stocks |

11.48% |

|

Bonds |

8.50% |

|

Short-term reserves |

1.46% |

|

TOTAL |

100% |

Let me provide three pieces of context so you understand the WHY behind the numbers:

Lifecycle funds: The foundation for my portfolio

The majority of my investments are in lifecycle funds (aka target date funds).

Remember: Asset allocation is everything. That’s why I pick mostly target date funds that automatically do the rebalancing for me. It’s a no-brainer for someone who:

- Loves automation.

- Doesn’t want to worry about rebalancing a portfolio all the time.

They work by diversifying your investments for you based on your age. And, as you get older, target date funds automatically adjust your asset allocation for you.

Let’s look at an example:

If you plan to retire in about 30 years, a good target date fund for you might be the Vanguard Target Retirement 2050 Fund (VFIFX). The 2050 represents the year in which you’ll likely retire.

Since 2050 is still a ways away, this fund will contain more risky investments such as stocks. However, as it gets closer and closer to 2050, the fund will automatically adjust to contain safer investments such as bonds, because you’re getting closer to retirement age.

These funds aren’t for everyone though. You might have a different level of risk or different goals.

However, they are designed for people who don’t want to mess around with rebalancing their portfolio at all. For you, the ease of use that comes with lifecycle funds might outweigh the loss of returns.

For more information on lifecycle funds, check out my three-minute video on the topic below.

Minimal speculative investments

Speculative investments are dangerous.

These are investments that have the potential to earn a lot of money but also have the potential to lose big.

For example, when I just started out, I bought a bunch of stocks because that’s what I thought investing was. And there were three tech companies that I initially invested in. Two of them ended up going bankrupt — but I also bought stock in a little company called Amazon.com.

Guess what? I made a good amount of money off of that investment … and it’s not because I was smart. I was stupid. I just got incredibly lucky.

The lesson here isn’t “find the next Amazon.” It’s that you don’t know how to get lucky. I happened to stumble on dumb luck.

It’s possible that the next hundred companies I invested in went belly up because speculative investing is total gambling.

That isn’t to say that I’m totally against investments like buying individual stocks. In fact, I keep 10% – 20% of my portfolio for things like individual stocks and angel investments (very risky). But that’s all play money, or cash I’m willing to lose.

If you want to play the market, go ahead! Just make sure you have your foundation set up first — that means automated finances, and regular investments into mutual funds — and that you’re investing with money you’re willing to lose.

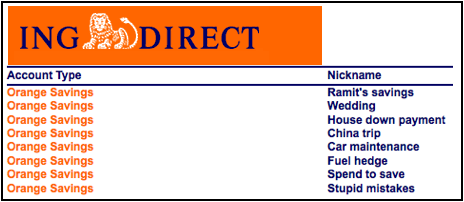

Savings held separately

The above is just my investment portfolio — it doesn’t reflect certain assets like my savings and sub-savings accounts.

This includes money I’ve saved up for my wedding, engagement ring, and even vacations.

My savings accounts used to look like this

Here’s an example of a couple sub-savings accounts I have now:

ING switched to Capital One 360, and I used the money I saved to buy an engagement ring

I also have an emergency fund with six months’ worth of living expenses in it. This is money stowed away in case of financial emergencies. I want to make sure I have money in the bank when these things happen so I don’t have to worry about supporting me or my family if things go wrong.

To find out how much you need in your emergency savings fund, you simply have to take into account three to six months worth of:

- Utility bills (internet, water, electricity, etc.)

- Rent

- Car/home payments

- Food/groceries

ANY living expense that you have should be accounted for.

You should also start an account exclusively for your emergency savings fund. When you do, you can start putting money into the account through my favorite system: Automating your personal finances.

The process only takes one to two hours at the most, but once you set it up, you don’t have to worry about it again.

AND it’ll save you thousands of dollars over your lifetime.

Here is a 12-minute video of me explaining the exact process I use below.

Why you shouldn’t use my portfolio

Like I mentioned above, this portfolio is tailored to my specific financial situation. Yours is going to be completely different from mine. As such, you’ll want to find a mix that works for you.

In my early days, I was solely focused on growth. Since my business has grown, I’ve had to adapt my investing strategy: I’ve intentionally made my portfolio more conservative.

If you’re young and just getting started, you’re probably going to want to be more aggressive since you’re better positioned to risk more — sensibly. (More on this in my book.)

No matter what, you still want to make sure you’re diversified to help safeguard yourself against the worst financial situations.

That’s why I spent years getting my asset allocation right — and that’s why I’m happy you’re here.

If you’re interested in things like diversifying your portfolio, I want to give you something that can help you start building that portfolio today.

In it, you’ll learn how to:

- Master your 401k: Take advantage of free money offered to you by your company … and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Spend the money you have — guilt-free: By leveraging the systems in this book, you’ll learn exactly how you’ll be able to save money to spend without the guilt.

Enter your info below and get on your way to living a Rich Life today.

Diversified portfolio examples: A guide to diversification is a post from: I Will Teach You To Be Rich.

from I Will Teach You To Be Rich http://ift.tt/2BDusXH

#money #finance #investing #becomerich